Solar and wind cannibalisation manifest a strategic miscalculation at the heart of IPP portfolio construction. This article explains why typical IPP portfolio construction compromises value creation, the three actions IPP leaders and owners can deploy to reverse this, and the consequences for service and technology suppliers.

The default IPP 1.0 strategy, of scaling one technology across many geographies, solves yesterday’s problem: the political risk which curtailed solar’s first deployment cycle. It diversifies market risk but it concentrates cannibalisation risk. Regrettably, cannibalisation is now the greater threat.

Cannibals at the door

Solar provides a stark illustration. Accelerating European solar installation is exacerbating the systematic depression of midday electricity prices, then spread by interconnected transmission grids. The resulting transition of duck curves to canyon curves has become a staple of board discourse and risk management committees. Germany’s solar capture rate has declined rapidly from 98% three years ago to 54% ytd; Spain is already this low[1]. Even last year, Germany experienced negative pricing in 5% of all hours (456 hours).

Figure 1: Solar eats itself

We must not flinch from this critical insight: single-technology portfolios amplify rather than diversify cannibalisation risk. A pure-play solar IPP with assets across Spain, Germany, and Italy experiences synchronized merchant revenue destruction during high-irradiation periods, with negligible hedging capability. The same holds true for wind.

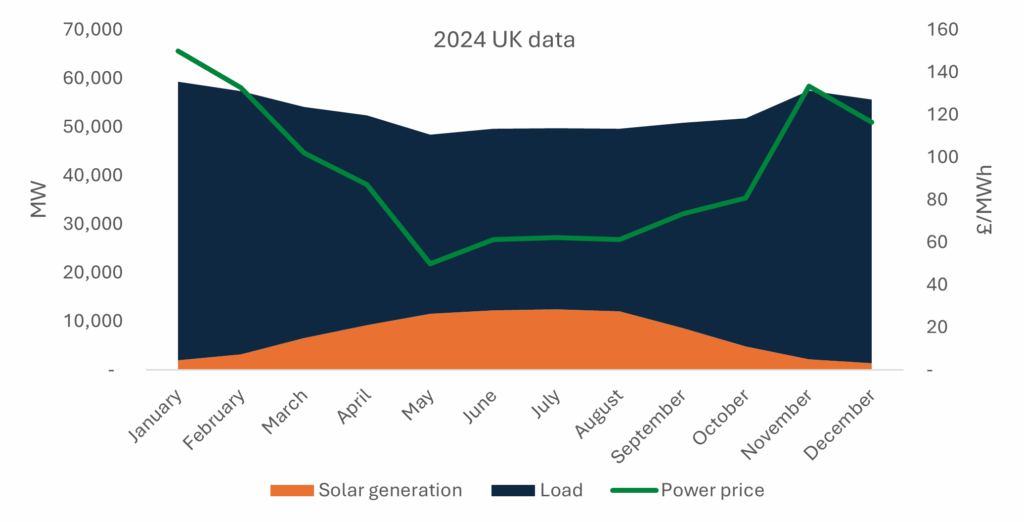

Figure 2: Accelerating cannibals

The financial impact is severe. In 2024, fair value PPA prices for Spanish solar collapsed 80% year-on-year to €15.59/MWh, and German solar fell 47% to €42.34/MWh, reflecting intensifying oversupply dynamics and an evaporating green premium.

This is not temporary cyclical oversupply: high renewables penetration drives structural price cannibalisation. Cannibalisation has opened a Pandora’s Box which is already curtailing asset values.

For infrastructure funds stewarding multi-billion euro renewables portfolios, the implications demand strategic recalibration. The path forward requires an immediate pivot to revalue IPP output: towards integrated, firm green power delivery through diversified technology platforms concentrated in select markets. To thrive, the IPP 2.0 strategy revamp must swap ‘one technology, many markets’ for ‘many technologies, few markets’.

The Corporate Customer Evolution

Simultaneous with cannibalisation, the displacement of subsidies by market demand is forcing the renewables industry, for the first time, to attract customers. Customers want cheap, reliable energy. Unfortunately, contracted solar is neither cheaper (than the spot wholesale prices) nor reliable. As a result, we are seeing some troubling (but mixed) evidence that the CPPA [corporate PPA] market is contracting. Pexapark reports German solar CPPA volumes fell a remarkable 84% in H1 2025, to just 228 MW[1]. Solar’s alternative is to compete on price in subsidy rounds. But these increasingly punish negative pricing events, and subsidies are limited: the troubling implication is many RTB projects may be valueless.

Figure 3: CPPAs recede fast

To avoid competing on price alone, to attract corporate buyers, and to progress these stranded assets, IPPs need to offer the ‘firm green power’ that customers demand and standalone renewables cannot deliver: economic renewable energy with baseload reliability, matching consumption patterns.

BESS is not the answer

To date, BESS has been the industry’s default response. BESS is a requirement, but it is not the solution. Multi-hour BESS can never remedy the monthly or seasonal weather patterns that firm green power contracts must address. This requires a third non-correlated energy source (or more). These ‘Trinity’ portfolios may combine solar’s daytime peak with wind’s evening and winter generation, and storage systems sized for extended discharge periods. Trinity portfolios can transition their offering from commodified electrons to a premium service (24/7 CFP – Carbon Free Power).

Yet the stark reality is that, as currently configured, almost every European IPP is wholly incapable of offering this, as they are overweight in dual technologies. So a choice now confronts their boards: sell commodified electrons for portfolio aggregators to monetise at mark-up, or reconfigure your portfolio to capture this reliability premium.

‘Trinity Technology’ diversification reduces output correlation, thereby smoothing revenue volatility across seasonal and weather patterns. In a co-located form, the shared infrastructure (grid connections, substations, operations centres) can reportedly deliver capital efficiency gains of 10-15% compared to standalone developments. But most critically, integrated portfolios facilitate firm power product offerings accessing premium pricing and longer contract tenures from corporate offtakers.

The optimal IPP 2.0 portfolio will balance geographic concentration (to capture operational synergies, customer access and market expertise) with technology diversification (to reduce correlation risk and enable firmer products). This favours deep market positions in 3-5 countries over broad exposure across 7+ markets. This is not easy, and the model has potential weaknesses, but it is unquestionably superior to the negligible returns from selling standalone solar electrons to unwilling corporates or saturated spot markets.

Biting the bullet on portfolio churn

This remedial rebalancing demands extensive portfolio turnover, to recycle equity from non-core countries and overweight technologies, into acquiring expertise and assets in the previously excluded technologies. This is a long road, but single-technology portfolios otherwise face value erosion in an oversupplied and obsolete market, while geographically concentrated multi-technology portfolios will command premium valuations.

The Trinity Transformation

To deliver a concentrated portfolio exploiting the uncorrelated output of Trinity technologies (e.g. solar, wind, storage), the evidence points toward three decisive actions for European renewable IPPs and their infrastructure fund owners:

1. Portfolio Audit and Rebalancing: Systematically evaluate existing assets for cannibalisation exposure, contract coverage, and firming potential. Prioritize divestment of correlated or isolated assets with capital redeployed to technology diversification unlocking firming capabilities.

2. Geographic Consolidation: Concentrate market presence to enable portfolio scale and risk management, better project interconnection and customer relationship development. Develop 3-5 core European markets where the regulatory frameworks, and robust CPPA demand support integrated renewable development. Exit other countries to recycle equity.

3. Firm Power Product Development: Invest in commercial capabilities to structure and deliver firm green power products combining solar, wind, and storage assets. This requires enhanced customer development, forecasting, trading, and risk management capabilities beyond traditional project development expertise, alongside firm grid capacity contracts.

In effect, solar IPPs may acquire merchant BESS and exchange their fringe country solar for core country wind. Wind IPPs will be counterparts to these transactions, but may also merge with solar IPPs. Our connectivity can deliver these off-market transactions.

This will reshape technology providers too. Fragmentated asset management services cannot support trinity portfolios or hybrid PPAs. Asset Performance Managers [APMs] must accelerate acquisitions in adjacent technologies.

This window for strategic repositioning is open – but not indefinitely. As cannibalisation impacts intensify (approximately doubling every year), IPPs delivering firmer green power products should secure market premia and access to capital. Obsolete single-technology, merchant-exposed strategies will face capital flight and margin compression.

Conclusion

In all mature markets, the renewable energy revolution is moving beyond capacity deployment to commercial sophistication. The IPP 1.0 model solves yesterday’s problem, but its dysfunction is to concentrate cannibalisation risk. It is now time to acknowledge this, to adapt and to act. Failure to do so, may jeopardise sponsor’s ability to exit their investments in future.

This requires Opus to change too. We have experience transacting across all technologies, but we now require all staff to develop knowledge in hybridised offtake and colocation strategies so we can support clients in delivering Trinity Transformations, and capitalising on the opportunity this shift presents. We have reconfigured to support you.

[1] https://modoenergy.com/research/germany-2025-solar-cannibalisation-glut-subsidies-power-prices-bess, 19 Aug 2025

[2] https://pexapark.com/blog/unpacking-the-h1-2025-decline-4-1-key-trends/